Summary

A teenage boy created and released three memecoins, earning over $50,000 by selling his holdings before the price crashed (“soft rug pull”).

The backlash was swift, with the boy and his family doxed and facing threats from angry traders.

While the legality of such actions is unclear, the incident highlights the risks and ethical dilemmas in the unregulated memecoin market.

“I bought snake oil from a very trustworthy travelling salesman. Turns out it was just piss with ink and when I turned around he had skipped town!”

Tale as old as time m8. Play stupid games, win stupid prizes.

Bitcoins should be used as god intended: buying prescription drugs from India. Most everything else is a circlejerk of stupid.

Is this really a thing? Do you have any recommendations?

I’m not sure what current market place is the go to, but I would tread with caution.

I was in a bad way with Xanax a few years ago and used to order them on a darkweb marketplace, I nearly ruined my life and risk death from withdrawals.

There is also the risk of other chemicals being found in prescription drugs , such as fentanyl which can kill you with even trace amounts of it.

All that said I made dozens of orders and only ever had one not arrive. It goes without saying you should be making small orders for money you’re happy to lose. It’s often not the seller that will rip you off, but the marketplace doing an exit scam.

Wasn’t there a news piece about an eyedrop from India that killed a few people and made others go blind because of some bacterial infection?

Yea, some medicine exported from India to African countries had quality issues, there was also another news about a cough syrup which caused child death

This isn’t heavily controlled stuff. Antidepressants, heart medication, gi prescriptions, stuff insurance should cover but deductibles, yada yada. Sky Pharmacy.

Only fools use Bitcoin for shit like this when Monero exists.

Edit: To clarify, I mean for privacy and security purposes. I’ve got no intention of selling anyone on crypto lol

Ahh, there it is. I’m a fool. I don’t care what the stroke to tip ratio or whatever is on Bonero. I’m not interested in the technical wanking details. I merely wish to purchase goods and services.

I’m not investing in crypto. That’s what precious metals, the stock market, and real estate are for.

Bitcoin costs me $3 a transaction or so, everybody takes it, it’s easy.

Oh I’m not talking about that shit either but OK.

I was assuming you meant buying illegal (or quasi-legal) drugs, and in that case, using Bitcoin is very dumb.

I use dogecoin because it has lower fees and a cute dog in the app

We truly are in a golden age of scams.

If the deregulation of cryptocurrencies happens in the US, it will get even worse except for the predators.

deregulation

It’s never been regulated in the first place.

Well, it was not as regulated as e.g. the stock market, but regulation of cryptocurrency was there and improving - with all the benefits and drawbacks.

In the very early days there were no KYC and AML policies at all.

Taking back the little regulation that has been introduced in the last few years doesn’t improve customer protection.

A “Gilded Age”, you might say

And total morons. Anyone losing on crypto deserves the loss.

Tell me again how this nonsense will replace old fashioned “fiat currency” any day now.

No one has ever explained to me how crypto coins are not fiat currency considering they’re not backed by any commodities whatsoever.

They are significantly worse than fiat currencies.

That’s fair.

The vast majority are, but not all of them.

Albeit it’s hard to find those that aren’t.

What about if you take out inflation and offer transactions for zero fees while operating a network with little appetite for (electric) energy?

That would mean you’d never be left with dust amounts you can’t spend and no entity could debase your holdings by issuing more currency units.

Then the price would just be the result of supply and demand.

Of course that’s not what that teenager did or what the vast majority of cryptocurrencies do, but how it could and should be done.Inflation IS the result of supply and demand (and other market forces such as the velocity of money).

You would need a mechanism to control the value of the currency to prevent inflation. Maybe an institution that offers loans could achieve this by adjusting the interest rate.

It would have to be a government entity, you wouldn’t want this responsibility to be in the hands of anyone with a profit motive. Maybe some kind of reserve bank operated by a federal government. We could call it the Federal Reserve.

You’re righr. I wasn’t specific enough. I meant inflation of the supply, the currency units. Increasing the supply can cause loss of real purchase power aka inflation.

With a stable supply and only the forces of supply and demand in place, real purchase power loss or increase are possible, which means there can be inflation or deflation.

Then the price would just be the result of supply and demand.

Since financial institutions will still own most of it, it will still be the same, except instead of the central bank doing it publicly, random hedge funds will be pumping and dumping randomly, and we can all go “the market works in mysterious ways”.

If financial institutions own most of it and aren’t regulated accordingly, what you say seems to hold true.

As soon as there’s sufficient regulation in place or financial institutions don’t own most of it, it won’t look so bleak.I mean they already do own most of it, and crypto proponents specifically like it because it is unregulated.

Wouldn’t be crypto if the Fed would have a say in its value.

Are you saying that financial institutions own most of all crypto in existence or do you mean Bitcoin specifically?

Financial institutions own most of everything in existence at this point, but Bitcoin specifically I’m sure they own enough for some nice pump and dumps.

It’s not like it will be on their official books.

Yeah, that may very well be the case and it’s hard to verify or falsify it.

I’m no proponent of crypto, but it’s clearly not meant to be backed by a commodity. When crypto people are taking about fiat currency, they’re talking about the fact that it’s state-issued.

That is literally what a fiat currency is.

It’s state-issued and not backed by a commodity.

No, it’s just not backed by a commodity. That’s why it is currency by fiat. Company scrip is fiat currency and it’s not issued by any government.

I get that you crypto fans don’t want your currency backed by nothing to be the same as all the other currencies backed by nothing except that, unlike crypto, nations actually support them and their citizens use them en masse, but that’s just the way things are.

You’re just being obtuse. It does no good to argue about some obscure definition of the term, when that’s not how it’s being used.

Company scrip can also be issued by a central authority.

I think crypto is stupid, but so is your made up argument over terminology.

It’s not an obscure definition.

But fine, if the any government adopts crypto, like some people seem to want, it will be fiat currency.

Stop.

Don’t feed the troll.

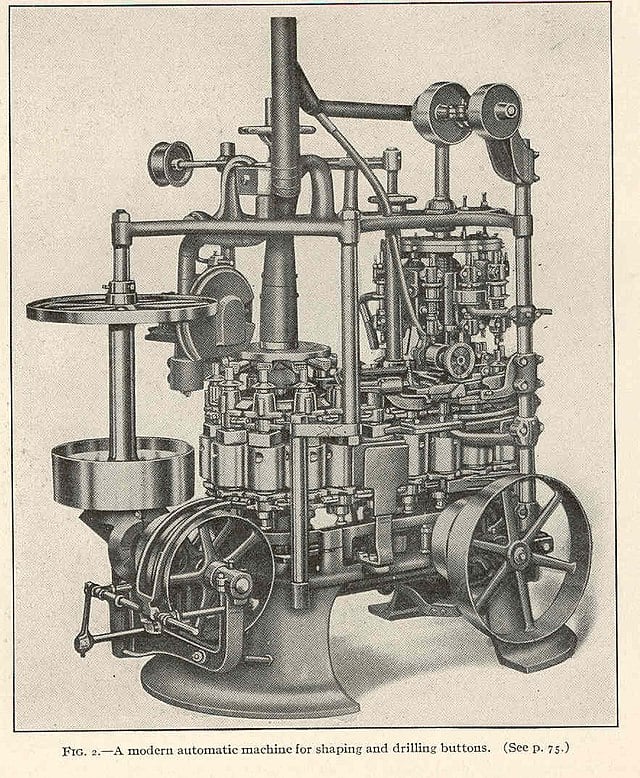

Wait I feel like I remember reading about stuff like this in the early days if stock trading, people making fake companies, selling stocks and running off, more stringent rules started being put in place in the 1920’s-30’s

This is exactly why more regulation is needed in the space if they want it to be successful in the long term. But crypto bros can’t seem to be able to bring themselves to care about the long term (though I’m not sure I would either if I was made a multimillionaire overnight because of a memecoin or some shit)

The coin isnt fake tho, its exactly what its supposed to be.

Meme coin goes badly? How did I not see this coming?

I don’t know, sounds like it went pretty well to me.

Operation failed successfully

Play stupid games.

Don’t hate the player, hate the game.

No regulations needed here, nope.

I’d really like to see every new coin get rug pulled and crypto bros stop pulling their grift cuz nobody listens anymore instead.

They’re just hoping they’ll be the ones to rug pull others. For the ones believing in the long-term prospects, they assume bitcoin will always continue going up (even with some dips along the way) and that stablecoins will cover the other use cases.

Caveat emptor